Sales to the Estonian market increased to 5.7 (Q2 2019: 5.0) million euros in year-on-year comparison, accounting for 14.7% (Q2 2019: 12.4%) of consolidated revenue for the reporting quarter. The servicing of the framework procurement for Elektrilevi OÜ’s new substations has started, but some supply difficulties of materials and components caused by the crisis situation have slowed down the growth of the expected revenue on the Estonian market. In total, sales to the Estonian market have increased by 0.8 million euros to 9.4 million euros in six months, accounting for 12.6% of the 6-month consolidated revenue.

Sales in the Group’s largest market, Finland, have been declining year-on-year. The revenue of the reporting quarter decreased by 3.2 million euros to 19.0 million euros and was mostly affected by the delay in the supply of equipment. There was no major change in the revenue compared to the first half of the previous year, the six-month revenue to the Finnish market was 38.5 million euros, accounting for 52.0% of the consolidated revenue. Production of the Finnish power grid companies comprised the greater part of the sales volume. The Group has reached the delivery of the first projects in Finland with the solutions of the HECON row cabinet system product line, that was developed within the Group, and where customers have provided positive feedback.

The revenue earned from the Swedish market in the reporting quarter was 5.9 million euros, which is 0.3 million euros more than in the second quarter of 2019. The share of the Swedish market in consolidated sales increased by 1.3 percentage points to 15.2% in the reporting quarter. In the first half of the year, revenue in Sweden increased by 1.5 million euros to 10.9 million euros, remaining as the third market. The growth was primarily ensured by the increase in sale of substations in Sweden. As at the end of the quarter, 86.2% of the orders in the framework agreement entered into in 2018 with E.ON Energidistribution AB, the largest distribution company in Sweden, had been delivered. In addition, ten compact substations were delivered to the Ellevio AB network on the Swedish market during the reporting period.

Norway ranks fourth of the Group’s markets, accounting for 11.2% of the Group’s revenue in the second quarter. The revenue earned in the reporting quarter was 4.4 million euros, decreasing by 1.1 million euros compared to the second quarter of 2019. In contrast, the Norwegian market earned 9.8 million euros in the first half of the year, an increase of 0.3 million euros. The majority of the sales volume on the Norwegian market originated from the sale of products directed at the shipbuilding sector. In addition to the Lithuanian subsidiary, the Estonian manufacturing company also contributed to the growth of the Norwegian market, sending three HEKA1SB substations to Norway in the reporting quarter.

In a quarterly comparison, sales to the Netherlands market remained at the same level, amounting to 1.8 million euros. In a six-month comparison, sales to the Netherlands market have fallen by 0.4 million euros to 3.1 million euros.

Sales to other markets increased the most, by 1.7 million euros year-on-year and in six-month. The largest of the Group’s other markets were Denmark, Germany and Poland, which generated revenue of 1.3 million, 0.3 million and 0.6 million euros, respectively, in six months.

Business segments

As is tradition, the largest part of the revenue, 85.0% in the reporting quarter and 85.4% in the first half of the year, was generated by Production, which is the main business activity of the Group. Some supply difficulties due to the special situation reduced the revenue of the Production segment by 2.8 to 33.1 million euros on a quarterly basis Supported by the increase in sales volumes of the companies of the Group that manufacture electrical equipment, the sales volume of the production segment increased by 1.7 million euros to 63.2 million euros in six months.

The revenue of the Real estate segment has decreased compared to previous periods. This is due to the temporary rent reduction agreements to ensure the tenants’ coping with the difficult situation. In Q2, lease income from the rental premises of Keila, Allika and Haapsalu Industrial Parks was earned in the amount of 0.77 (6m 2019: 0.83) million euros and 1.61 (6m 2019: 1.70) million euros in six months.

The revenue of Other activities was 5.1 million euros in the Q1, which is 1.3 million more than in the second quarter of 2019. The six-month revenue has also increased significantly: 2.5 million euros. The revenue of the project sales of electrical goods mainly originated from customers in the power network and other infrastructure fields, construction companies and the public sector; revenue of electrical installation works originated from the shipbuilding sector.

Operating expenses

Operating expenses for the reporting quarter have decreased in all expense groups – a total of 2.4 million euros. The decrease in the cost of sales outpaced the decrease in revenue by 1.7 percentage points, increasing the gross profit margin by 1.5 percentage points compared to the second quarter of 2019. Distribution expenses have decreased the most compared to the comparable quarter, by 0.3 million to 1.2 million euros, accounting for 3.2% of the Group’s operating expenses in the second quarter. The share of distribution expenses in the Group’s revenue has decreased by 0.6 percentage points year-on-year to 3.0%. While the increase in distribution costs in the comparable period was caused by the focus on export growth, then due to the global coronavirus (Covid-19), most sales work has been done virtually in the period under review. To prevent the loss-making consequences, special attention is given to the availability of materials in production units and security of supply regarding purchase and procurement activities.

Overall, the increase in operating expenses compared to the first half of the year was 2.0 percentage points lower than the increase in revenue. Operating expenses for the first half of the year totalled 71.0 (6m 2019: 68.3) million euros, of which the largest increase – 2.6 million euros was the cost of sales. The gross profit margin increased by 1.3 percentage points to 14.0 compared to the comparable period. The share of administrative expenses in the Group’s revenue was 6.0% of the revenue of the reporting quarter and 6.6% in the first six months, remaining at the same level of the Group’s operating expenses compared to both periods of the previous year.

Compared to the second quarter of 2019, labour costs for the last quarter decreased by 0.1 million euros to 6.7 million euros and increased by 0.1 million euros compared to six months. The ratio of labour costs to the Group’s revenue decreased to 18.1% (6m 2019: 19.0%) in the first half of the year. In the first six months, the cost of share option programs in the amount of 120 (6m 2019: 89) thousand euros has been recognized as labour costs.

Depreciation of non-current assets totalled 0.9 million euros in the second quarter and 1.8 million euros in the first half of the year, increasing by 58 and 88 thousand euros, respectively, compared to the comparable period.

Personnel

In order to service the increased production volumes in the new production building, the number of employees of the Lithuanian subsidiary has increased by 18 people during the year. At the same time, Estonian companies have hired less seasonal labour in the reporting quarter than in the comparable period, partly due to the restructuring and postponement of holidays. At the end of the reporting period, the Group had 829 employees, which was 19 employees less than a year ago. During the reporting quarter, the Group employed an average of 789 people, which was an average of 10 employees more than in the comparable period. In the reporting quarter, 5.3 (Q2 2019: 5.5) million euros were paid to the employees in salaries and remuneration. Average wages per Group employee was 2,195 (Q2 2019: 2,335) euros.

Investments

In the reporting period, the Group invested a total of 2.2 (6m 2019: 3.0) million euros in non-current assets, incl. 1.3 (6m 2019: 0.2) million euros in investment properties, 0.8 (6m 2019: 2.6) million euros in property, plant and equipment and 0.1 (6m 2019: 0.2) million euros in intangible assets. In Q1, preparations for the construction of the fourth stage of expansion of the production and office building in Lithuania were started. In addition, investments were made in the construction of a production facility in the Allika Industrial Park, and plots of land were purchased.

Changes in the management of Group companies

The Supervisory Board of AS Harju Elekter decided at its meeting held on March 16, 2020 to appoint the current member of the Management Board, Tiit Atso, as Chairman of the Management Board as of May 4, 2020. The former Chairman of the Management Board, Andres Allikmäe, took the position of Head of Business Development at AS Harju Elekter, following the expiration of his Management Board member contract at 3 May 2020. The Management Board of AS Harju Elekter will continue with two members – Tiit Atso (Chairman of the Board) and Aron Kuhi-Thalfeldt (Member of the Board).

As of 1 January 2020, a new CEO has been appointed for Swedish subsidiaries SEBAB AB and Grytek AB. Mikael Schwartz Jonsson started working with the Harju Elekter Group on 1 October 2019. The long-term CEO of SEBAB AB and Grytek AB, Thomas Andersson, took the position of Sales and Marketing Director in Sweden from 1 January 2020.

Main events in the second quarter

- In order to simplify the coordination of sales and marketing work and the management of Swedish subsidiaries, Harju Elekter decided to merge its Swedish subsidiaries SEBAB AB and Grytek AB during 2020 into one company of Harju Elekter Group.

- The Finnish business newspaper Kauppalehti awarded Finnkumu Oy with the “Achievers 2020” title. Such acknowledgement is given to companies with a well-established economic activity, stable growth, good results and profitability, strong financial structure, and liquidity to ensure sustainable activity.

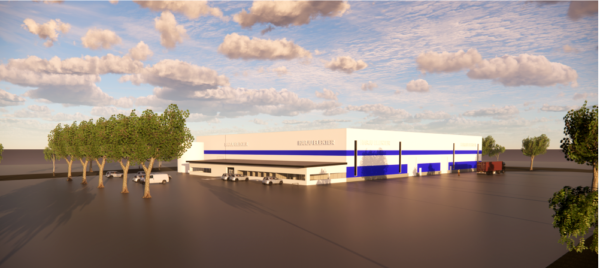

- On 22 May 2020, the cornerstone was laid for AS Harju Elekter’s Laohotell II in Saue Parish, Allika Industrial Park. The total area of the building, which will be completed this autumn, is 3,877 square metres. Laohotell II is the fifth real estate of AS Harju Elekter to be taken into use in the 30 ha with 18 land plots Allika Industrial Park in Harku near Paldiski Road.

- Energo Veritas OÜ closed its unprofitable Keila store as of 31 May 2020, and customer service throughout North Estonia was transferred to the company’s new sales office in Tallinn, Tuisu 19.

- On 30 June 2020, the AGM of shareholders of AS Harju Elekter was held; it approved the 2019 annual report and the proposal for distribution of the profit and decided to pay shareholders a dividend of 0.14 euro per share for 2019, totalling 2.5 million euros. Dividends were transferred to shareholders’ bank accounts on July 21, 2020.

Events after the reporting period

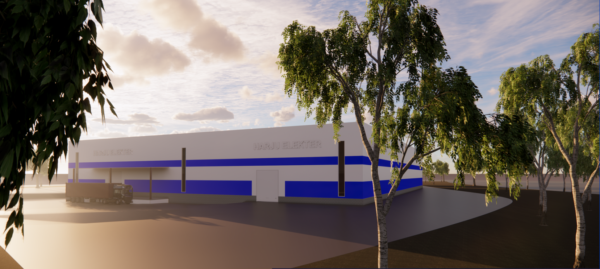

In July 2020, it was decided that in September, the Lithuanian subsidiary of AS Harju Elekter, Harju Elekter UAB, will commence Step 4 of expanding its factory in Panevėžys. The construction works will be performed by Kaminta UAB and the works are scheduled to be finished in March 2021. After the construction works have been completed, the office and manufacturing area of the Lithuanian subsidiary will increase from the current 8,765 m2 to 16,761 m2. The total cost of the investment is up to 6 million euros, of which 70% will be financed by bank loan and 30% from own resources.

Investments directed at expanding the factory enable Harju Elekter UAB to double the factory revenues. Following enlargement, the number of employees will increase from the current 241 to 350.

Harju Elekter UAB focuses on providing detailed engineering of products, services and solutions and production for export for the marine and industrial sector system integrators, with delivering client-specific solutions of frequency inverters and power distribution systems. Harju Elekter UAB has DNV GL and RINA certificates.

The share

The company’s share price on the last trading day of the reporting quarter on the Nasdaq Tallinn Stock Exchange closed at 4.39 euros.

| AS HARJU ELEKTER | ||

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION 30.06.2020 | ||

| Unaudited | ||

| EUR’000 | ||

| ASSETS | 30.06.20 | 31.12.19 |

| Cash and cash equivalents | 3,906 | 4,878 |

| Trade receivables and other receivables | 26,788 | 22,958 |

| Prepayments | 1,879 | 1,166 |

| Inventories | 21,958 | 19,010 |

| TOTAL CURRENT ASSETS | 54,531 | 48,012 |

| Deferred income tax asset | 517 | 472 |

| Non-current financial investments | 8,047 | 10,494 |

| Investment property | 22,173 | 21,259 |

| Property, plant and equipment | 19,918 | 20,402 |

| Intangible assets | 7,199 | 7,260 |

| TOTAL NON-CURRENT ASSETS | 57,854 | 59,887 |

| TOTAL ASSETS | 112,385 | 107,899 |

| LIABILITIES AND OWNERS’ EQUITY | ||

| Interest-bearing loans and borrowings | 6,772 | 11,305 |

| Advances from customers | 2,824 | 2,212 |

| Trade payables and other payables | 24,202 | 16,448 |

| Tax liabilities | 3,559 | 2,959 |

| Short-term provision | 160 | 34 |

| TOTAL CURRENT LIABILITIES | 37,517 | 32,958 |

| Interest-bearing loans and borrowings | 8,264 | 7,901 |

| Other long-term liabilities | 97 | 64 |

| NON-CURRENT LIABILITIES | 8,361 | 7,965 |

| TOTAL LIABILITIES | 45,878 | 40,923 |

| Share capital | 11,176 | 11,176 |

| Share premium | 804 | 804 |

| Reserves | 2,673 | 3,412 |

| Retained earnings | 52,003 | 51,699 |

| TOTAL OWNERS’ EQUITY | 66,656 | 67,091 |

| Non-controlling interests | -149 | -115 |

| TOTAL EQUITY | 66,507 | 66,976 |

| TOTAL LIABILITIES AND OWNERS’ EQUITY | 112,385 | 107,899 |

| CONSOLIDATED STATEMENT OF PROFIT AND LOSS

1-6/2020 |

||||

| Unaudited | ||||

| EUR’000 | Q2 2020 | Q2 2019 | 6M 2020 | 6M 2019 |

| Revenue | 39,014 | 40,606 | 74,012 | 69,889 |

| Cost of sales | -33,546 | -35,519 | -63,621 | -61,014 |

| Gross profit | 5,468 | 5,087 | 10,391 | 8,875 |

| Distribution costs | -1,180 | -1,474 | -2,488 | -2,682 |

| Administrative expenses | -2,333 | -2,450 | -4,895 | -4,634 |

| Other income | 275 | 83 | 327 | 131 |

| Other expenses | -74 | -51 | -126 | -188 |

| Operating profit | 2,156 | 1,195 | 3,209 | 1,502 |

| Finance income | 71 | 24 | 108 | 125 |

| Finance costs | -46 | -61 | -147 | -104 |

| Profit before tax | 2,181 | 1,158 | 3,170 | 1,523 |

| Income tax expense | -210 | -329 | -496 | -529 |

| Profit for the period, attributable to | 1,971 | 829 | 2,674 | 994 |

| owners of the Company | 1,979 | 843 | 2,708 | 1,025 |

| non-controlling interests | -8 | -14 | -34 | -31 |

| Basic earnings per share (EUR) | 0.11 | 0.05 | 0.15 | 0.06 |

| Diluted earnings per share (EUR) | 0.11 | 0.05 | 0.15 | 0.06 |

Tiit Atso

Chairman of the Management Board

+372 674 7400